SIREN FX BENCHMARKS

The company's methodology is designed with special characteristics for trading, aiming to reduce market impact and deliver lower-cost execution for clients. SIREN FX is regulated under the UK's Financial Conduct Authority (FCA) benchmarking regime, ensuring compliance with industry codes of conduc

Why SIREN FX Benchmarks?

SIREN FX gives asset owners and asset managers the transparency and tools they need to improve their decision-making in respect of the execution of their investment related foreign exchange activity, and instruct their executing banks accordingly, while achieving compliance with industry codes of conduct.

SIREN FX offers a fully transparent, lower-cost alternative to existing FX benchmarks, by providing a path to validate what the true costs are in execution, making it a compelling solution for asset owners and their asset managers, who have struggled to meet their fiduciary duty to ensure adequate transparency under Principle 9 of the FX Global Code of Conduct.

Understand your excess costs

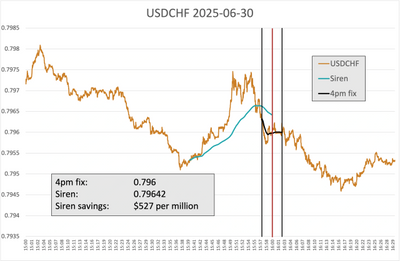

By undertaking a SIREN savings study a fund can make a comparison between total execution costs paid using the 4pm fix and what it would have paid had the SIREN FX benchmark been deployed.

Once a clear and transparent understanding is established the trustees of the fund will have the vital data to hand for decision making purposes to protect the fiduciary integrity of the fund.

Overview: What sets SIREN FX apart

Based on an FCA approved and regulated independent FX spot benchmark

SIREN FX is a benchmark calculated using benchmark quality data giving a high degree of assurance

Reduced market impact

SIREN FX is designed to reduce market impact caused by benchmark execution

20 minute window

Allows greater liquidity absorption

Optimal execution algorithm

This reduces FX arbitrageurs ability to profit at investors detriment and reduces costs

Pre-hedging participation

Investors explicitly participate in the

pre-hedging window so benefit from better earlier prices

Real-time data feed

Liquidity providers can reduce tracking error using our real-time feed

Month-End Review: Significant 4pm fix price distortion

SIREN FX green line on the graph highlights the substantial savings that can be achieved using Siren

Over the last 3 years’ SIREN FX has been calculating and analysing the savings the pension funds could be saving using the SIREN FX 20-minute FX Benchmark calculation across currency pairs, compared to the alternative five-minute 4pm fix window.

Each month SIREN FX will present the data and analysis of random currency pairs, using the same guidelines that are used for the regulatory reported pairs for you to study.

We will briefly comment on any factors that may have impacted the market to assist with getting a clear view on what effect this may have on the FX market and importantly on potential savings.

Colin Lambert from The Full FX is an independent market observer who examines how random currency pairs have performed at month end. click here to see his latest review.

Contact Us

* SIREN FX is published by NCFX who are regulated and authorised as a benchmark administrator by the Financial Conduct Authority.

Copyright © 2024 www.sirenfx.co.uk site - All Rights Reserved.